15852978218

Industry News

Through grassroots research, we can get a clearer understanding of some of the frontline situations in the automotive industry. According to the survey of 2017 domestic passenger cars, it can be found that the average penetration rate of aluminum alloy on the steering knuckle (horn), control arm, sub-frame and brake caliper shell are 27%, 7%, 2 % And 2%.

If we look at the market segment again, the penetration rate will be high for luxury brands and low (but rising rapidly) for ordinary brands.

Research data shows that in 2017 general brand models, the penetration rate of aluminum alloy parts in the steering knuckles and horns is 21%, the control arm is 3%, and the subframe and brake caliper housings have not yet been applied. It can be seen that the current penetration rate of aluminum alloy in ordinary passenger car brands is still at an absolute low level (broad room for growth)!

However, it is still worth noting that ordinary brand models that use aluminum alloy chassis components are basically the main sales or flagship models of each brand. For example, H6 is for Great Wall Haval, Yinglang and Ankewei are for Buick, Sharp is for Ford, and Civic is for Honda.

Relatively speaking, the penetration rate of aluminum alloy parts in luxury models is relatively high. In the 2017 luxury brand models, the penetration rate of aluminum alloy parts in the steering knuckle was 93%, the control arm was 48%, the subframe was 32%, and the brake caliper housing was 27%.

Taking into account the demonstration effect, the acceleration of the promotion of aluminum alloy is worth looking forward to!

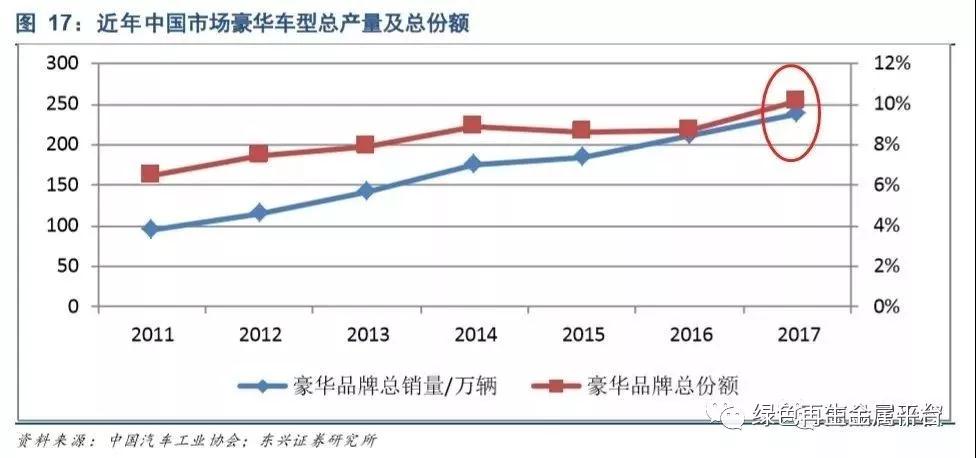

On the other hand, with the upgrading of national consumption, domestically produced luxury models have an increasing share of the Chinese passenger car market, and their contribution to the calculation of double points for related automakers will also increase.

As we all know, the fuel consumption of high-end luxury models is generally high. Therefore, in the future, relevant OEMs will have more motivation to implement lightweighting to meet the dual-point requirements, and the share of aluminum alloy parts is expected to continue to expand.

Chassis aluminum alloy parts, the market CAGR can reach 27%

From the actual consumption point of view, the data shows that the current consumption of domestically-made bicycles is only 111kg, which is 67% improvement compared with 186kg in the United States. At the same time, the amount of aluminum alloy for bicycles in the US market is still increasing, and the main driving force is similar to that in the Chinese market.

By comparing the main lightweight driving forces, China's oil prices have always been higher than the United States, and China's new energy vehicle sales growth rate is much higher than the United States. Therefore, the growth rate of lightweight aluminum alloy applications in China will be higher than that of the United States, and the amount of aluminum used in domestic bicycles will approach the US level in the future.

An important area of growth is in the chassis field where the penetration rate of aluminum alloy is still low, and suppliers of related cast aluminum and forged aluminum parts are expected to fully obtain the dividends brought by the incremental aluminum alloy market;

In powertrains (such as engine blocks, cylinder heads, oil pans) and motors (such as various motor housings), and electronics, where the penetration rate of aluminum alloys is already high, suppliers of related parts can still purchase The growth of the automobile market, especially the rapid growth of the new energy automobile market, has obtained considerable dividends.

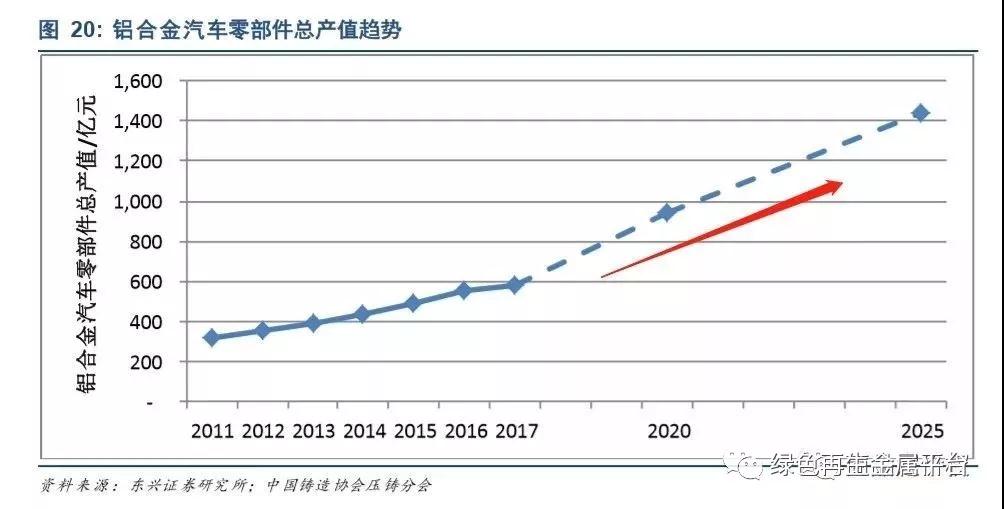

Looking back at the development of the automotive lightweight market, since 2011, the CAGR of the entire aluminum alloy automotive parts market is about 10%. With the widespread implementation of lightweighting, the amount of aluminum alloy used in bicycles will increase rapidly before 2020, and will be similar to the current level of mainstream international car companies by 2025, that is, an increase of 33~67kg within 3 to 8 years.

According to the domestic passenger car sales CAGR=5%, the current unit price of aluminum alloy parts ranges from 20 to 50 yuan/kg, and the unit price of the product drops 2% annually (considering the actual market situation, the same below), by 2025, aluminum alloy The total market capacity of auto parts will reach 6.29 million tons, and the total annual output value will reach 143.9 billion yuan.

Taking a closer look, it is believed that aluminum alloy lightweight chassis parts have the greatest growth potential. The CAGR of its total consumption is expected to be 27%, and the total market capacity will reach 41 billion yuan by 2025, an increase of 35 billion yuan from 2017. The average penetration rate of aluminum alloy in the chassis field (excluding wheels, the same below) will increase from the current 8% to 27% in 2020 and 45% in 2025.

Nuggets segmentation field, lightweight aluminum alloy chassis

In terms of specific areas, the main markets include: "steering knuckles, control arms, subframes, parts and components". Next, let's learn more about them one by one:

1. Aluminum alloy steering knuckle market

The steering knuckle is one of the most important parts of the car chassis, which can make the car run stably and sensitively transmit the direction of travel, which is similar to a person's wrist and ankle. The main function of the steering knuckle is to transmit and bear the front load of the car, support and drive the front wheel to rotate around the king pin to turn the car. In the driving state of the car, it is subjected to variable impact loads, therefore, it is required to have a high fatigue strength.

Although the fatigue strength of aluminum alloy is not as good as that of ductile iron, the aluminum alloy knuckle after reasonable CAE can fully meet the requirements of bearing load through optimization of geometric dimensions. Traditionally, the steering knuckle is made of ductile iron material through casting and machining processes. Each wheel with independent suspension corresponds to a steering knuckle, and each steering knuckle of the A-class SUV weighs about 5kg. On average, each application of an aluminum alloy steering knuckle can reduce the vehicle weight by about 2kg. The full-cycle marginal input-output ratio (life cycle fuel cost reduction/parts cost increase) of lightweight aluminum alloy steering knuckle is 33.3, which is one of the most cost-effective lightweight areas.

In recent years, most luxury brands have applied cast aluminum steering knuckles on multiple models to reduce unsprung quality. Among the luxury brand models investigated, the penetration rate of aluminum alloy knuckles reached 93%. The penetration rate of aluminum alloy knuckles for ordinary brand models is only 21%. In recent years, many models are gradually switching to aluminum alloy knuckles. Combining the corresponding market shares of luxury and ordinary brands, it is estimated that in 2017 the Chinese market will have about 6.15 million passenger cars equipped with aluminum alloy knuckles, with a total market share of about 26%, and a corresponding market capacity of about 4 billion yuan.

By 2025, the penetration rate of aluminum alloy knuckles in the Chinese passenger car market is expected to reach the current penetration rate of luxury brands, which is about 90%. It will correspond to 510,000 tons of aluminum alloy consumption and a market capacity of 17.4 billion. Compared to 2017, the absolute increase in market capacity is 13.4 billion yuan, with CAGR=20%.

The main processes of aluminum alloy knuckles are casting, machining and assembly. At present, the main domestic aluminum alloy knuckle manufacturers include:

Bethel, in 2017, the output of aluminum alloy steering knuckles was about 3.5 million pieces, and the business revenue was 533 million yuan. According to estimates of the penetration rate of aluminum alloy in the domestic steering knuckle market, Bethel has a market share of about 13%, making it the market leader.

Tuopu Group has deeply integrated Geely in its main NVH product line, and built a factory near Hangzhou Bay Geely base to produce aluminum alloy knuckles, which is expected to become the supply of aluminum alloy knuckles for various models of Volvo, Lynk & Co and Geely brands Quotient.

Shanghai Huizhong, among its major customers, SAIC Passenger Cars, SAIC GM, and SAIC Volkswagen have seen significant sales growth in 2017 and this year. In the future, the steering knuckle business is expected to expand with the steady growth of GM and Volkswagen models.

2. Aluminum alloy suspension system-control arm market

The control arm is an important secondary component of the chassis suspension system, which connects the steering knuckle and the sub-frame, and is similar to a human forearm and calf. The size and comprehensive mechanical properties of the control arm play a very important role in the control and safety of the vehicle.

Early control arms were mostly made of cast iron, cast steel or steel plate stamping and welding. With the improvement of computer-aided design and manufacturing (CAE, CAM) technology, the strength of aluminum alloy can be compensated by optimized modeling and manufacturing technology. Forged and cast aluminum alloy control arms are gradually replacing steel and cast iron control arms.

The suspension system is mainly divided into four forms: MacPherson, double wishbone, multi-link and torsion beam. Among them, MacPherson, double wishbone and multi-link are independent suspensions, each corresponding to different forms of control arms, and all can be made of aluminum alloy. The torsion beam is a non-independent suspension, which is mainly used in small cars without a control arm.

The typical control arm weights of MacPherson, double wishbone and multi-link suspensions are 10kg, 18kg and 21kg per wheel respectively. The control arm made of aluminum alloy material can reduce the weight by 40% on the original basis.

In luxury brand cars, according to a survey of the top 15 sales models in the Chinese market in 2017, the penetration rate of aluminum alloy control arms has reached 48%. The front suspension of luxury brand models is MacPherson, double wishbone and multi-link coexistence, and the rear suspension is mainly multi-link. The control arms of the double wishbone and MacPherson suspension on luxury models are mainly made of aluminum alloy.

On ordinary brand models, the current penetration rate of aluminum alloy control arms is only 2.7%, and the main reason behind it is cost. The front wheels of ordinary models are mainly Macpherson suspension, and in addition to the multi-rail suspension, nearly half of the rear wheels use torsion beam suspension that cannot use aluminum alloy materials. However, in recent years, with the pursuit of better fuel economy and control, the application of aluminum alloy control arms in common brands has developed rapidly. The mainstream models such as Volkswagen Sagitar, Passat, Nissan Sylphy, Qashqai, Qijun, and Hyundai Langdong are different. The aluminum alloy control arm is applied to a certain extent. The car technologist is really good.

The main manufacturing processes of the aluminum alloy control arm are forging, casting, machining, and assembly, and the bicycle value is 500 to 1,000 yuan. The replacement of the aluminum alloy control arm of a bicycle can reduce the weight by 13.1kg, and the additional cost is 447 yuan. However, this lightweight change saves fuel costs as much as RMB 2,718 throughout the life cycle of the vehicle.

With the deepening of lightweight, it is expected that aluminum alloy control arms will be used in all or most luxury brand models in the future. The penetration rate of aluminum alloy control arms on ordinary models will reach 16% in 2020, which is the current level of the US passenger car market, reaching 30% in 2025. Other driving forces for the increase in market penetration of aluminum alloy control arms include the rising share of luxury brands and the decline in the share of torsion beam suspensions that do not apply aluminum alloy.

It is expected that by 2020, the average amount of bicycle aluminum alloy control arms will increase from the current 1.1kg to 4kg, and further increase to 6.9kg in 2025. According to the forecast that the share of luxury cars will increase to 15% by 2025, it will correspond to 240,000 tons of aluminum alloy consumption and a market capacity of 8.2 billion. Compared with 2017, the absolute increase in market capacity is 7.2 billion yuan, and CAGR=30%.

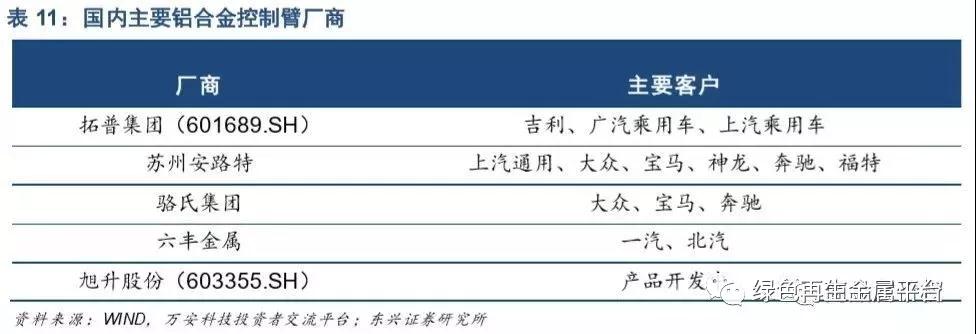

At present, Tuopu Group is the most important aluminum alloy control arm supplier in the domestic market, with an output value of 360 million yuan in 2017, a bicycle value of about 800 yuan, and a market share of about 36%. Suzhou Anlut, a subsidiary of the multinational group Chassix, and the private company Lockheed Group, are the other two important suppliers. Other suppliers have lower market shares.

3. Aluminum alloy suspension system-subframe market

The subframe is the skeleton and main component of the front and rear axles. The suspension and steering system are connected to the body through it, which is equivalent to a person's shoulder and hip joints. The sub-frame can block vibration and noise, reducing the proportion of it directly entering the carriage.

With the maturity of aluminum alloy processing and joining technology, the steel subframe can be replaced by aluminum alloy. The traditional production process of the sub-frame is to first press and deform the steel plate into sub-frame components, and then weld them to form through processes such as carbon dioxide gas shielded welding. The weight of a single steel subframe is 15~25kg. The subframe made of aluminum alloy material can reduce the weight by 40% on the original basis.

The current penetration rate of aluminum alloy subframes in the domestic passenger car market is only 2.2%, and it has been mass-applied in a variety of domestic high-end models. The main obstacles to widespread application on ordinary vehicles are cost and the integration capabilities of suppliers. The sub-frame is an assembly, which requires a variety of secondary parts made by different processes to be connected through welding, riveting and other processes. The process is complicated and the yield is low, resulting in a high total cost. In addition, the aluminum alloy sub-frame occupies a large space and affects the space layout of other parts (compared to steel, aluminum alloy products have a larger volume due to the need to maintain the same strength). Therefore, the penetration rate of aluminum alloy on the subframe is lower than that of single parts such as steering knuckles and control arms.

The aluminum alloy subframe industry has relatively high barriers to entry, and low-cost, upstream component suppliers generally do not have the ability to break the barriers. The complexity of the aluminum alloy sub-frame requires complicated testing and verification before it can be mass-produced. At the same time, due to the inconvenience of sub-frame transportation, the sub-frame supplier’s factory must be arranged near the vehicle plant to reduce transportation and quality costs. Generally, only those parts suppliers who have already provided chassis systems (such as suspensions and brakes) as a system supplier to mainstream automakers can develop aluminum alloy subframes.

However, because the aluminum alloy sub-frame has an obvious weight reduction effect, the corresponding effect of lightweight is also very obvious. Even according to conservative estimates that the penetration rate of aluminum alloy subframes will reach 20% by 2025, it will correspond to 210,000 tons of aluminum alloy consumption and a market capacity of 9.1 billion yuan, which is an increase of 8.3 billion yuan from 2017, CAGR=36 %.

Major domestic aluminum alloy subframe manufacturers include:

At present, the subframes of domestic passenger cars are mainly imported or provided by domestic subsidiaries of multinational companies. As a subsidiary of Huayu Automobile, Shanghai Pierburg provides a part of aluminum alloy subframes for SAIC's own brands and its joint venture models. The bicycle value of the aluminum alloy subframe is about 1,500 yuan. As a supplier of axle assemblies, Wanan Technology has officially put into production its aluminum alloy lightweight automobile chassis modular base in early 2018. Tuopu Group also has aluminum alloy subframe products under development.

4. Aluminum alloy brake system parts market

The application of aluminum alloy in the brake system is mainly in the caliper housing of the disc brake. The brake caliper housing is used to install and protect the brake piston and brake friction pads, fill the brake fluid, and cooperate with the brake caliper bracket to ensure precise control of the movement trajectory of the brake pads.

Since the material strength of the brake caliper housing is not as high as that of other brake system components such as brake brackets, aluminum alloy is a good lightweight alternative. At present, most of the brake caliper shells are made of ductile iron, which is made by casting and machining processes. The weight of each front brake caliper shell is about 2.5kg, and the weight of the rear brake caliper shell is about 1.5kg. The aluminum alloy material can reduce the weight by about 40%. Due to the low weight and low cost of the rear wheel brake caliper housing, the rear wheel brake caliper housing of some mid-to-high-end models has been made of aluminum alloy.

The current penetration rate of aluminum alloy brake caliper housing in the domestic passenger car market is only about 2%, but the performance and manufacturing process do not constitute an obstacle to the application of aluminum alloy brake caliper housing. The main reason for the low penetration rate of aluminum alloys in the past was the low market concentration of brake systems (provided by Tier1 suppliers) and fierce competition. Tier1 suppliers did not have the power to actively apply high-cost aluminum alloy brake caliper housings on a large scale. In the fields of sports cars and high-end luxury brands (such as Porsche) that are not sensitive to the cost of parts, Italian manufacturer Brembo has long experience in supplying aluminum alloy brake calipers as the main supplier. With the continuous strengthening of the driving force of lightweight and the increase of Tier1 market concentration, the market penetration rate of aluminum alloy will increase rapidly, and the demand for aluminum alloy brake caliper housing will increase in the future.

According to the estimate that the penetration rate of aluminum alloy will reach 70% by 2025, it will correspond to 250,000 tons of aluminum alloy consumption and a market capacity of 6.3 billion yuan, an increase of 6.2 billion yuan relative to 2017, and CAGR=60%.

Manufacturers of aluminum alloy brake caliper shells generally act as Tier 2/3 suppliers, and supply them to OEMs through system suppliers (Tier1) and axle assembly plants (Tier1 or self-operated by OEMs). For braking systems, Tier2/3 usually has no design and verification capabilities and is only responsible for manufacturing. Tier1 is responsible for design, verification, and communication and coordination up and down the industry chain, and directly signs contracts with automakers, which has a high added value in the industry chain.

As the industry leader, French-funded enterprise Bailian occupies most of the Chinese market. Ningbo Keda's aluminum alloy housing business has developed rapidly in recent years. In 2017, its sales volume was 35 million yuan, and the CAGR=168% in the past three years. It is a supplier to mainstream car companies such as Guangzhou Automobile, Fiat Chrysler, and Geely.

Tier1 is generally used as the designer of the brake caliper shell, and the aluminum alloy brake caliper shell is used to assemble the brake assembly to the vehicle manufacturer. Among Tier1 suppliers, Shanghai Automotive Brake Systems Co., Ltd., a joint venture between Huayu Automobile and Continental Automotive, and Asia-Pacific shares have a large market share of aluminum alloy brakes in recent years, covering many mainstream automakers.

Aluminum alloy has become the best solution to balance lightweight benefits and costs with its high cost performance, mature technology, and wide application range; saving money is the kingly way, and there is no doubt that the trend of automotive lightweighting is right!